Newsroom

Sokoman Announces Closing Of Non-Brokered Private Placement

St. John’s, NL, December 16, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that it has received approval from the TSX Venture Exchange to close its non-brokered private placement of flow-through shares (the “Private Placement”) announced on December 2, 2020.

The Company will issue 15,000,000 flow-through shares at a price of $0.20 per flow-through share for aggregate gross proceeds of $3,000,000. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

In connection with the private placement, the Company will pay $164,397 in finders’ fees and will issue 764,550 broker warrants exercisable at $0.20 for 12 months from the date of issue, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four-month hold period.

Sokoman would like to thank all the participants and interested parties for the overwhelming support in this Private Placement. The proceeds of the financing will be directed towards advancing the Company’s flagship Moosehead Gold Project. Sokoman is continuing with its Phase 6 drill program at Moosehead and after taking a break for Christmas holidays, it will resume drilling in early 2021 with multiple high-priority targets yet to be tested. With the necessary funds in place, the Company plans on expanding the program beyond initially announced 10,000 m.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Files For Exchange Approval To Close Non-Brokered Private Placement

St. John’s, NL, December 14, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that it has filed documents with the TSX Venture Exchange seeking final approval for its non-brokered private placement of flow-through shares (the “Private Placement”) announced on December 2, 2020.

On receipt of all regulatory approvals, the Company will issue 15,000,000 flow-through shares at a price of $0.20 per flow-through share for aggregate gross proceeds of $3,000,000, including $48,500 taken by the insiders of the Company. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

Upon receipt of regulatory approval and in connection with the private placement, the Company will pay $164,397 in finders’ fees and will issue 764,550 broker warrants exercisable at $0.20 for 12 months from the date of issue, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four-month hold period.

The proceeds of this financing will be directed towards advancing the Company’s flagship Moosehead Gold Project.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Non-Brokered Flow-Through Private Placement

St. John’s, NL, December 2, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that, subject to all regulatory approvals, the Company intends to complete a non-brokered private placement of flow-through shares (the “Private Placement”). The Private Placement is expected to be filed with the Exchange on or around December 11, 2020.

Sokoman intends to issue flow-through shares at a price of $0.20 per flow-through share for gross proceeds of up to $2,000,000. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

In connection with the Private Placement, the Company will pay finders’ fees of 6% cash and 6% broker warrants, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the Private Placement will be subject to a four month and one day hold period.

The proceeds of this financing will be directed towards advancing the Company’s flagship Moosehead Gold Project.

“With approximately 6,000 m of a proposed 10,000 m Phase 6 completed and with excellent results so far, including MH-20-115 returning 4.60 m at 47.2 g/t Au and 8.1 m at 68.7 g/t Au (November 17, 2020 News Release), we are tapping into seasonal flow-through funds available now to ensure we have the flexibility to expand our current Phase 6 program this winter. We still have numerous high-priority targets to be tested and it is becoming clear that 10,000 m will not be enough to test all key targets. We expect to be drilling well into 2021, quite possibly until spring breakup,” said Tim Froude, Sokoman’s President & CEO.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Stock Option Grant

St. John’s, NL, November 27, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announces a stock option grant to officers, directors, employees and consultants of the Company, subject to TSX Venture Exchange approval, for up to a total of 3,000,000 common shares of the Company. These stock options are exercisable at CDN $0.22 per stock option, which represents a 30% premium to a current share price.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Cuts Two High-Grade Intervals At Eastern Trend, Moosehead Project, Central Newfoundland: 4.6 M At 47.2 G/T Au And 8.1 M At 68.7 G/T Au

Near-Surface, High-Grade Splay Identified at Eastern Trend

St. John’s, NL, November 19, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing drilling at the Moosehead Project has returned high-grade gold in a near-surface, newly recognized splay off of the main Eastern Trend. Drill holes MH-20-115 and MH-20-116 were collared to the south of discovery hole MH-18-01, as part of the Company’s 10,000-metre Phase 6 program.

Rush assay results (metallics) from MH-20-115 returned two intersections* as follows:

upper interval of 47.20 g/t Au over 4.60 m from 64.00 m downhole

lower interval of 68.70 g/t Au over 8.10 m from 111.20 m downhole

*reported lengths are core lengths and are believed to be 60 to 70% true thickness

Rush assays for MH-20-116, located 10 m further south of MH-20-115, also intersected 2 zones, including an upper interval of 11.85 g/t Au over 1.80 m from 54.50 m downhole, and a lower interval of 2.94 g/t Au over 4.30 m, including 7.57 g/t Au over 1.25 m, from 183.80 m downhole.

Tim Froude, President and CEO of Sokoman, says: “The drill results continue to demonstrate the high-grade nature of the gold mineralization at the Moosehead Project. They also reinforce the importance of tighter drill hole spacing in these Fosterville style gold systems which provide key insights into high-grade gold variability and orientation. The Phase 6 program is continuing with one drill due to limited equipment availability given the high level of exploration in the province. As a result, we will be testing high-priority targets defined by till and magnetic surveys while we wait for all the pending assay results. We expect the drilling to continue into 2021, since several targets require winter conditions to allow access and we are also applying for permits for ice-based drilling in the winter.”

The upper intervals in MH-20-115 and 116 are interpreted to occur in a footwall splay off of the upper levels of the main Eastern Trend and correlate with an intercept in MH-18-01 (located ten metres to the north) that assayed 7.11 g/t Au over 1.25 m. MH-18-01 also included a higher-grade subinterval of a visible gold bearing quartz vein that assayed 35.04 g/t Au over 0.25 m. The splay is modelled as a northwesterly trending structure with a shallow 30-degree dip to the north. The location of the splay merger with the north trending Eastern Trend could influence and focus high-grade gold in this area.

The splay is open to the south and west, and due to its orientation was not targeted in earlier drilling campaigns. Further modelling of these intercepts will take place before additional drilling is proposed for this highly prospective area. Similar high-grade splays are associated with the high-grade Swan Zone at the Fosterville gold mine in Australia.

The lower intersections in MH-20-115 and 116 extend the Eastern Trend Main zone at least 20 m to the south (remains open), which includes the MH-18-01 intercept of 11.90 m grading 44.96 g/t Au among others. The mineralization in MH-20-115 and 116 is consistent with earlier intersections in the Eastern Trend and characterized by moderate to strong stylolitic quartz veining similar to the Fosterville deposit in Australia. The strong association with antimony sulphides, mainly boulangerite, represents an additional similarity to Fosterville. (see photos here)

Phase 6 Drilling Program

A total of 4,009 metres in 15 holes has been completed testing target areas including three holes in the Western Trend (MH-20-111, 113 and 114) and 12 holes in the Eastern Trend. Drilling in the Western Trend focused on testing deeper portions of the zone and all three holes intersected structures with variable quartz veining with disseminated pyrite and arsenopyrite. To date, only MH-20-114 has been sampled and assays are pending; the other two holes, MH-20-111 and 113, are in various stages of logging and sampling.

Drilling on the Eastern Trend has involved a combination of deeper, 50-100-m spaced holes testing below the 200-metre vertical level at the north end with shallow targets in the southern portion, where only a single shallow hole (MH-20-122) has tested the zone. This drilling also includes the lower intersections in MH-20-115 and 116 as discussed above.

Mineralized shears and faults were encountered in all holes as expected, with detailed logging and sampling underway. Holes MH-20-112 and 120 intersected structures with quartz/sulphide veins with specks of visible gold in veins 30 to 50 cm wide in the main Eastern Trend shear zone. Numerous wide intervals (10-30 metres) of shearing with variable amounts of quartz veining with locally 1-3% pyrite and arsenopyrite were encountered in the deeper testing of the Eastern Trend, specifically holes MH-20-99 and 100. While not returning high grades, the holes did hit some of the thickest intersections of mineralized and altered rocks to date and suggest the zone continues to depth and will receive deeper testing later in the program. Several holes remain to be logged and sampled with assays pending for multiple holes except those in the accompanying table. Select intervals from holes with visible gold noted are being prioritized for rush analysis.

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization.

The mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (as in MH-18-39).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

Phase 6 Current Table of Results

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Receives Final Till Sample Results At Moosehead Gold Project; Multiple New Drill Target Areas Identified

Sokoman to Host a Webinar on Tuesday, October 20 at 2 PM EST

St. John’s, NL, October 16, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it has received final till sampling results, including a follow-up phase of sampling, from the Moosehead Project in North Central Newfoundland. The results for the 201 total samples have identified 13 sites of anomalous gold grain counts ranging from 20 to 111 gold grains.

Tim Froude, President and CEO of Sokoman, states: “The till results represent some very high priority targets which will be drill tested as part of this 10,000 m program. Multiple magnetic features, possibly representing structures, can be identified spatially associated with all of the till anomalies and could be potentially mineralized structures. Some of these features may require winter conditions to allow for effective testing. That will not be a problem as winter drilling is not an issue at Moosehead. We are pleased to see so many anomalous samples corresponding with potential structures as outlined in the winter magnetic survey and anticipate testing the highest priority areas that show both anomalous till results with associated structures.”

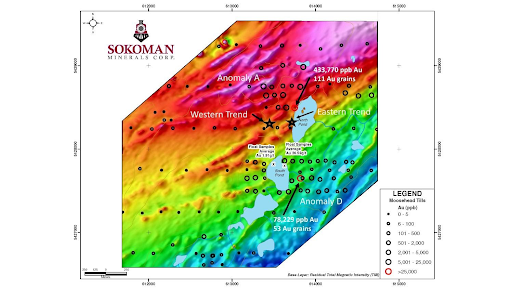

Anomalous sample sites at the Moosehead Property have been determined to be those with more than 20 gold grains, which is a minimum of 2 times background (see map attached). The corresponding

calculated gold content for the same data set ranges from 831 ppb Au to 433,770 ppb Au. A portion of the area sampled is presented on a base map featuring the Residual Total Magnetic Intensity from the airborne survey the Company had flown in January of this year.

The highest priority till targets are summarized as follows:

Till Anomaly A

Located immediately north and northwest of North Pond, a portion of this anomaly appears to represent the down ice dispersion from the Eastern and possibly the Western Trend mineralized zones. Additional drilling is required in this area as assumed glacial movements suggest that the known zones of mineralization do not explain the distribution of anomalous till samples. Calculated Au content for anomalous samples ranges from 831 ppb to 440,770 ppb Au and includes the highest gold grain count of 111 gold grains including 57 pristine grains. Portions of the anomaly remain untested by diamond drilling, specifically the eastern and western margins.

Till Anomaly D

This anomalous area is located immediately East of South Pond and not directly tested by diamond drilling. This anomaly contains the second highest calculated gold content of 78,229 ppb Au with gold grain counts up to 53 grains including 28 pristine grains. This area lies 400 m southeast (up-ice) from the high-grade float recently reported (July 30, 2020 News Release) from South Pond including grab sample assays ranging from 0.32 to 157 g/t Au.

Phase 6 Drill Program

The Company is currently in the midst of a planned 10,000 m diamond drilling program with logging and sampling underway. A total of 2,100 metres has been completed to date with four holes testing the Eastern Trend and three holes testing the Western Trend. While no firm timeline can be provided regarding the announcement of final assay results, the Company should be in receipt of partial results from these holes in 3-4 weeks.

Webinar Announcement

Sokoman Minerals will host a Zoom webinar on Tuesday, October 20, 2020 at 2 PM Eastern Time, where President & CEO Tim Froude will discuss the latest press release and provide an update on Phase 6 drill program. Register in advance following the link below:

https://us02web.zoom.us/meeting/register/tZAocOCupj0iHdE94TvalY1jI6mTmGbz8Chj

After registering, you will receive a confirmation email containing information about joining the meeting.

Till Sampling and Analytical Procedures

The initial phase of sampling consisted of the collection of 132 screened (to less than 8 mm) C-horizon till samples, weighing approximately 10 kg each, from sites spaced 250 metres apart, on lines spaced 500 metres apart, as recommended by Overburden Drilling Management (ODM) of Ottawa, Ontario. ODM specializes in the design and processing of till sampling programs globally. An additional 69 samples were collected in areas of anomalous gold grain counts on spacings half that of the initial sampling (125 metres between samples on lines spaced 250 metres apart). All tills were hand dug with depths ranging from 30 cm to almost 1 m below surface. Samples were placed in sealed plastic bags and shipped, unprocessed, in pails to ODM’s facility in Ottawa for washing on a shaker table and panning of the heavy mineral concentrates. Gold grains, where present, were extracted for morphological study and measurement. Gold content was then calculated for each sample by ODM based on number and size of gold grains in each sample. Assaying and ICP analysis of the heavy mineral concentrate will take place at Activation Labs in Ancaster, Ontario, expected in 4-6 weeks.

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold) and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization.

Since acquiring the project in 2018, Sokoman has continued to produce outstanding drill results including the following Eastern Trend highlights* from the 5 Phases completed to date:

Phase 1 MH-18-01 11.90 m @ 44.96 g/t Au, incl. 5.65 m @ 93.56 g/t Au

Phase 2 MH-18-39 5.10 m @ 124.20 g/t Au, incl. 1.10 m @ 550.30 g/t Au

Phase 3 MH-19-62 7.20 m @ 22.35 g/t Au, incl. 4.80 m @ 33.59 g/t Au

Phase 4 MH-19-81 6.40 m @17.34 g/t Au, incl. 1.45 m @ 75.50 g/t Au

Phase 5 MH-20-86 5.20 m @16.85 g/t Au, incl. 1.35 m @ 61.11 g/t Au

The mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open. *Reported lengths are core lengths believed to be 70%-90% of true thicknesses.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Update

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting *Marathon Gold’s Valentine Project that has estimated **proven mineral reserves of 1.3 million ounces (26.3 million tonnes at 1.52 grams per tonne) and probable mineral reserves of 600,000 oz (14.8 million t at 1.23 g/t). Total measured mineral resources (inclusive of the mineral reserves) comprise 1.9 million oz (31.7 million t at 1.86 g/t) with indicated mineral resources (inclusive of the mineral reserves) of 1.19 million oz (23.2 million t at 1.60 g/t). Additional inferred mineral resources are 960,000 oz (16.77 million t at 1.78 g/t Au).

Sokoman also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has also applied for funding for the 2020 season.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

** Please refer to Marathon Gold’s website.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Mobilizes First Drill Rig To Moosehead Project, Central Newfoundland

St. John’s, NL, September 10, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it has awarded the Phase 6, 10,000 m drilling contract to Springdale Forest Resources of Springdale, Newfoundland. The contractor is presently mobilizing the first drill rig to the property and field preparations have begun, with the first core expected early next week. A second rig will be moved onsite once it returns from a previous commitment, which is expected in 2-3 weeks.

Tim Froude, President and CEO of Sokoman, says: “We are pleased that Springdale Forest will be returning to the Moosehead Project. Their experience with the rocks, and overall familiarity with the property, have been critical to our success to date in sometimes challenging conditions. While we will be testing several concepts, the program will have a strong focus on the Eastern Trend, including the down-dip and along-strike extensions. Plans include testing of the 400 m vertical level along a 200 m section of the interpreted Eastern Trend structure, with holes also testing for high-grade mineralization at the 250, 300 and 350 m levels. It’s time to test this system at depth, and we have sufficient funding to do that.”

In addition, several holes will also be testing for the down-dip extension of the Western Trend, as well as select reconnaissance holes testing high-priority geochemical targets elsewhere on the property including the South Pond area where recent prospecting returned high-grade boulders assaying up to 157 g/t Au (July 30, 2020 Sokoman Minerals Corp. News Release) that strongly resemble the high-grade Eastern Trend mineralization located 400 m to the north.

The Company has merged the recently received C-horizon till sampling data with the winter heli-mag survey, and maps will be posted on the website in the coming days. Targets prioritized for drill testing include till samples returning up to 54 grains of gold (containing 34 delicate and slightly modified grains) situated over 1 km to the southwest (up-ice) of the Eastern Trend in an area with no previous drilling.

Moosehead Project

The 100%-owned Moosehead gold project is located along the Trans-Canada Highway in North Central Newfoundland, on the same trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization. Since acquiring the project in 2018, Sokoman has consistently produced outstanding drill results including the following Eastern Trend highlights* from the 5 Phases completed to date:

Phase 1 MH-18-01 11.90 m @ 44.96 g/t Au, incl. 5.65 m @ 93.56 g/t Au

Phase 2 MH-18-39 5.10 m @ 124.20 g/t Au, incl. 1.10 m @ 550.30 g/t Au

Phase 3 MH-19-62 7.20 m @ 22.35 g/t Au, incl. 4.80 m @ 33.59 g/t Au

Phase 4 MH-19-81 6.40 m @17.34 g/t Au, incl. 1.45 m @ 75.50 g/t Au

Phase 5 MH-20-86 5.20 m @16.85 g/t Au, incl. 1.35 m @ 61.11 g/t Au

*Reported lengths are core lengths believed to be 70% – 90% of true thicknesses.

The mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open for expansion.

COVID-19 Update

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting *Marathon Gold’s Valentine Lake project that has estimated proven mineral reserves of 1.3 million ounces (26.3 million tonnes at 1.52 grams per tonne) and probable mineral reserves of 600,000 oz (14.8 Mt at 1.23 g/t). Total measured mineral resources (inclusive of the mineral reserves) comprise 1.9 million oz (31.7 Mt at 1.86 g/t) with indicated mineral resources (inclusive of the mineral reserves) of 1.19 million oz (23.2 Mt at 1.60 g/t). Additional inferred mineral resources are 960,000 oz (16.77 Mt at 1.78 g/t Au).

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

Sokoman also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has also applied for funding for the 2020 season.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Receives Permits; Drilling To Begin At Moosehead Gold Project, Central Newfoundland

St. John’s, NL, August 24, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it has received the necessary permits to start Phase 6 diamond drilling at the Moosehead Gold Project in Central Newfoundland and is expecting the first drill on site shortly after the Labour Day weekend.

Moosehead Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same trend as the advanced Valentine Lake Project (Marathon Gold), and proximal to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization.

Since acquiring the project in 2018 and discovering the Eastern Trend mineralization in the first hole, the Company has intersected outstanding drill results in the Eastern Trend in all 5 drill phases completed. Highlights* from each of the 5 phases include:

Phase 1 MH-18-01 11.90 m @ 44.96 g/t Au, incl. 5.65 m @ 93.56 g/t Au

Phase 2 MH-18-39 5.10 m @ 124.20 g/t Au, incl. 1.10 m @ 550.30 g/t Au

Phase 3 MH-19-62 7.20 m @ 22.35 g/t Au, incl. 4.80 m @ 33.59 g/t Au

Phase 4 MH-19-81 6.40 m @ 17.34 g/t Au, incl. 1.45 m @ 75.50 g/t Au

Phase 5 MH-20-86 5.20 m @ 16.85 g/t Au, incl. 1.35 m @ 61.11 g/t Au

*Reported lengths are core lengths believed to be 70% – 90% of true thicknesses.

The mineralization has been defined over a 500 m strike length and to 200 m vertical depth and remains open for expansion along strike and to depth.

Tim Froude, President and CEO of Sokoman, states: “Now that all of the permits have been received, we can mobilize our crew and start site preparations for the largest drill program to date at Moosehead. The 10,000 m program will start with one drill targeting the strike extent of the lower main zone, where our previous drill programs have returned some of the highest-grade intersections in the district, including 4.80 m @ 33.59 g/t Au (MH-19-62) and 6.40 m @ 17.34 g/t Au (MH-19-81) at depths less than 200 m vertically. The zone is open to depth and along strike. A second drill will focus on extending the gold mineralization to depth with a series of holes testing to at least the 400 m vertical level. In addition, we will be testing newly defined targets such as the South Pond area where recent prospecting located high-grade quartz boulders with values up to 157 g/t Au (July 30, 2020 Sokoman Minerals Corp. News Release) that closely resemble the high-grade Eastern Trend mineralization located 400 m to the north.”

The Company has merged C-horizon till sampling data with the winter heli-mag survey to define targets for drill testing, including tills with up to 54 gold grains with 34 delicate / modified grains, indicating proximity to the source, 1 km to the southwest, up-ice of the Eastern Trend in an area with no previous drilling.

COVID-19 Update

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting *Marathon Gold’s Valentine Lake project that has estimated proven mineral reserves of 1.3 million ounces (26.3 million tonnes at 1.52 grams per tonne) and probable mineral reserves of 600,000 oz (14.8 million t at 1.23 g/t). Total measured plus indicated resources (inclusive of the mineral reserves) comprise 3.06 million ounces (54.9 million t @ 1.75 g/t). Additional inferred mineral resources are 960,000 oz (16.77 million t at 1.78 g/t Au).

Sokoman also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has also applied for funding for the 2020 season.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Is Presenting At The 2020 Global Mining Symposium On September 1-3

Sokoman Minerals is a Silver Sponsor at the upcoming Global Mining Symposium. See below for the details and registration link.

Register to join your peers, customers, and competitors September 1-3, 2020 in an open exchange of forward-looking ideas, established best practices and data-informed expectations.

As economies continue to reopen and adapt to the new global market landscape, every sector of the mining industry will benefit from having the best information possible. The 2020 Global Mining Symposium is an ideal opportunity to acquire and share this information.

Register to receive your secure link for the Global Mining Symposium. Keep your finger on the pulse of the mining industry and gain vital insight into its future, as well as your place in it.

Sokoman Minerals Extends Warrant Terms

St. John’s, NL, July 30, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) announces that it has applied to the TSX Venture Exchange (the “Exchange”) to extend the expiry date on 20,010,000 share purchase warrants (the “Warrants”), issued pursuant to a Private Placement Financing in August 2018, by 1 year to August 13, 2021. The Warrants’ original exercise price of $0.25 per share will not change.

About Sokoman Minerals

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project (with measured resources of 1.16 Moz. of gold at 2.18 g/t, indicated resources of 1.53 Moz. of gold at 1.66 g/t and inferred resources of 1.53 Moz. of gold at 1.77 g/t (Marathon Gold Website) 150 km southwest of the Company’s high-grade Moosehead gold project*. The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman is also applying for JEA funding for the 2020 season.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Reports Discovery Of High-Grade Boulders At South Pond, Moosehead Gold Project, Newfoundland

High-grade Eastern Trend-type boulders assay up to 157g/t Au and

include enriched silver values up to 36.2 g/t Ag

St. John’s, NL, July 30, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that prospecting at South Pond, 400 metres along strike to the south west of the Eastern Trend zone, has located a cluster of angular quartz float with high-grade grab sample assay results ranging from 0.318 g/t Au to 157.04 g/t Au, as well as enriched silver values up to 36.2 g/t Ag.

Unusually low water levels allowed prospectors to locate angular quartz float (from 0.2 to 0.5 m maximum dimension) from the northern end of South Pond, near where previous operators found two clusters of mineralized float, which assayed from 0.20 to 1.03 g/t Au, and from 5.4 to 17.5 g/t Au. The newly discovered boulders were located in two clusters (East and West), on opposite sides of a bay, displaying different mineralogy and precious metal grades. The following table shows detailed Au results using a total pulp metallics process, with silver (Ag) and antimony (Sb) from the ICP analyses also shown. Antimony is a key pathfinder metal for high-grade mineralization at Moosehead and at the Fosterville deposit in Australia which is considered to be an analogue for Moosehead given its stratigraphic and structural setting.

The average grade of the East cluster samples is 36.59 g/t Au and 11.01 g/t Ag, while the West cluster samples averaged 1.91 g/t Au and 1.28 g/t Ag. Three (3) samples were noted to contain visible gold (VG) and coarse fraction analysis (+150 Mesh) of 11 of the 20 samples, produced results suggesting coarse gold may have been present based on assays ranging from 58,175 ppb Au in sample 361068, to 2,238,802 ppb Au in sample 361051 (weighted averages for all samples are shown).

The attached sample map uses a background of total field magnetics from the 2020 winter airborne survey with the samples overlain, as well as historical and Sokoman drilling shown. While some drilling has taken place in the vicinity of the new float samples, it is most likely that the float originated to the south of their present location based on perceived ice-flow movements and three anomalous (10 ppb Au), lake sediment values in South Pond. The lake sediment results in South Pond are very encouraging given that similar strength lake sediment samples were also obtained at North Pond, where the Eastern Trend gold zone is located.

The magnetics show several NE as well as north trending structures trending under South Pond that may be related to in-situ mineralization, where little to no drilling has taken place. Modeling of the magnetics will allow effective planning for diamond drilling in the area, a priority for drill testing in the upcoming Phase 6 program. In the immediate area, visible gold was reported from holes MH-01-07, MH-02-34, and MH-18-41, although Au gave only anomalous values, suggesting the high-grade mineralization exhibited by the new sampling has not been tested to date. Should future drilling prove the existence of Eastern Trend mineralization at South Pond, the overall strike length could exceed 1 kilometre.

Tim Froude, President and CEO of Sokoman, said: “We are extremely pleased with the early results from our 2020 field program. While we await final permits for our 10,000 m Phase 6 drilling program, we initiated a follow-up prospecting and till sampling program in an effort to define additional targets for drill testing this year. The results from South Pond support reports of boulders in the area that assayed to a maximum of 17.5 g/t Au and suggest that extensions to the high-grade Eastern Trend mineralization lie untested in the South Pond area. The boulders located by our crew are of higher average tenor than the historical values with several boulders of similar grade to the highest grades from the Eastern Trend.

A portion of the Phase 6 drilling program will address the potential of the South Pond area which will include merging the winter magnetic survey with the new float samples. We will continue to update shareholders on developments in the coming weeks in advance of starting the Phase 6 drilling in late August/ early September. We are looking forward to exciting Q3 and Q4 and expect to be generating very positive news.”

COVID-19 Update

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

All rock samples were delivered by Sokoman personnel in sealed bags directly to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. All samples were submitted for assay by total pulp metallics with gravimetric finish as well as 34 element ICP analysis. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. Industry accepted blanks and standards were submitted by Eastern Analytical and results reported alongside the submitted samples as per the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project (with measured resources of 1.16 Moz. of gold at 2.18 g/t, indicated resources of 1.53 Moz. of gold at 1.66 g/t and inferred resources of 1.53 Moz. of gold at 1.77 g/t (Marathon Gold Website) 150 km southwest of the Company’s high-grade Moosehead gold project*. The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has also applied for funding for the 2020 season.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Reports Phase 5 Results At Moosehead Gold Project

All zones are open and expanding; upcoming 10,000 m Phase 6 drilling will test deeper targets

St. John’s, NL, July 15, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce drill results from the recently completed Phase 5 diamond drill program at the Company’s flagship Moosehead Gold Project located in north-central Newfoundland, with the lower high-grade shoot continuing to deliver strong results. The program extended both the upper main zone and the lower high-grade shoot to the north where the zones remain open and are now approximately 500 m in strike length remaining open to depth.

A total of 4,619 m was drilled in 17 holes targeting the lower high-grade shoot at the -200 m vertical level, as well as near-surface mineralization in the upper main zone. The lower high-grade shoot reported strong results including the following selected highlights:

MH-20-86 4.70 m @ 18.60 g/t Au, incl. 1.85 m @ 46.99 g/t Au (from 271.80 m downhole)*

MH-20-82 9.50 m @ 5.70 g/t Au, incl. 1.70 m @ 29.19 g/t Au (from 206.50 m downhole)*

*Note: reported lengths are core lengths; true widths are believed to be 75-90% of reported lengths

Summary table of all Phase 5 results is attached, with the length, grades, dip, azimuth, and presence of visible gold indicated. A drill plan showing the location of the Phase 5 holes is also attached, and an updated model and longitudinal are being prepared for posting when completed.

Tim Froude, President and CEO of Sokoman, said: “We are very happy with what we are seeing, especially with regards to the structure of the deposit. The Eastern Trend shows good continuity, continues to increase in strike length and remains open along strike to the north and south and to depth. As with most high-grade gold systems, variability of mineralization and gold grades are expected. We are eager to test holes to at least twice the current depth, to a 400-m vertical level, and our next phase of drilling will be our most aggressive program to date. The Phase 6, 10,000 m program, will be focused on testing the continuity of the zones, and deeper targets, while extending the strike length in 25-50 m increments.”

The Phase 6 program is expected to start sometime in August 2020, once the Company has received all necessary permits. Sokoman has also recently received the remaining till sample results and is compiling this data with earlier results from our survey and historical sampling. The 3-D modelling of the mineralization is ongoing and undergoing revision with each Phase of drilling. A revised model for the Eastern Trend, which will include the Western Trend, is being prepared and will be posted on the website when completed.

Phase 5 Geology

Several holes were drilled to test the interpreted southern, down-plunging portion, of the lower high- grade shoot, to infill a 75-metre gap between historical drill hole MH-03-15 (52.54 g/t Au / 2.34 m) and Phase 4 drill hole MH-19-69a (18.10 g/t Au / 1.45 m, including 82.17 g/t Au / 0.30 m). MH-20-82 intersected the lower high-grade shoot 25 m north of historic hole MH-03-15, giving 5.70 g/t Au / 9.50 m, including 29.19 g/t Au / 1.70 m.

Drill holes MH-20-83, 84 and 85a intersected mineralized vein material that had been subjected to later shearing and reworking. MH-20-87 intersected a veined zone which typically occurs immediately above or below the auriferous vein. While the zone was truncated by a fault, the interval gave 0.60 g/t Au / 6.0 m with the last interval before the fault giving 1.50 g/t Au over 0.50 m. These brittle-ductile structures which cut and deform the auriferous veins are not unexpected as mentioned in previous news releases of January 31, 2019 and November 19, 2019:

The highest-grade intersections (e.g. MH-18-01, 17 and 39) occur in a ductile-brittle Shear/Fault Zone of uncertain width which has a dip of 50 degrees East and a strike trend of 010 degrees.

The Shear/Fault Zone is a large-scale, kilometric structure of uncertain regional strike beyond the small drilled area with possible links to the regional faults/thrusts bounding the gold district. It may be the most important structure in the area, and therefore the central axis of the Au system. Strike continuation of the structure is unknown and undrilled. As well as along the strike continuation, the best potential may lie at depth where the structure intersects the regional NE striking thrust faults.

Vein style and host structures are typical of a sediment or intrusive hosted gold system controlled by reverse or strike-slip shears in a low-grade metamorphic, compressional regime.

The relationship between shearing and folding is similar to the Bendigo-Fosterville gold deposits in Australia. These deposits are commonly multi-structured with principal shear-vein structures having considerable strike and depth extent to >1,000 m as at Fosterville.

Seven holes were drilled from the ice on North Pond to test the extensions of the upper shoots of the Eastern Trend. The two discrete mineralized zones identified in 2019 were intersected in the current program. An upper zone intersected at shallow depths (30-40 m downhole) in 2019 was extended to the north at slightly deeper depths (40-50 m downhole). Best values from the current program were from MH-20-88 with 2.20 g/t Au / 1.10 m. The final two ice-holes drilled in 2019 intersected a lower mineralized zone 110 m downhole. This zone is interpreted to continue to the north with a potentially slight downward plunge. Best values were from MH-20-92 returning 7.85 g/t Au / 3.00 m, including 26.99 g/t Au / 0.85 m. The general trend of both mineralized zones is toward historic hole MH-02-38 which returned 112 g/t Au / 2.02 m.

The lower high-grade shoot has given some of the highest-grade results at Moosehead, including MH-19-62 (7.2m @ 22.35 g/t Au) and MH-19-81 (6.4 m @17.34 g/t Au). MH-20-86 cut the lower high-grade shoot approximately 10m below MH-19-81 returning a comparable grade of 16.85 g/t Au over 5.20 m. The final hole of the program, MH-20-98, intersected the lower high-grade structure at a down hole depth of 296 m returning 4.16 g/t Au / 5.65 m incl 8.21 g/t Au / 2.50 m. The intersection in MH-20-98 is 75 m northeast of MH-19-81 and 27 m northeast of MH-20-97 (6.31 g/t Au / 3.10 m). The zone remains open to the north and downdip to the east.

COVID-19 Update

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. (TSX.V: SIC) (OTCQB: SICNF) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project (with measured resources of 1.16 Moz. of gold at 2.18 g/t, indicated resources of 1.53 Moz. of gold at 1.66 g/t and inferred resources of 1.53 Moz. of gold at 1.77 g/t (Marathon Gold Website) 150 km southwest of the Company’s high-grade Moosehead gold project*. The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has also applied for funding for the 2020 season.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOKOMAN MINERALS CLOSES NON-BROKERED FLOW-THROUGH PRIVATE PLACEMENT

St. John’s, NL, June 23, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX-V: SIC; OTCQB:SICNF) is pleased to announce that it has received final approval from the TSX Venture Exchange (the “Exchange”) to close its non-brokered flow-through private placement (the “Placement”), previously announced on June 15th, for gross proceeds of $1,482,945. The Company will issue 12,895,174 flow-through shares at a price of $0.115 per flow-through share.

The private placement was effected with an insider of the Company subscribing for $300,000, that portion of the Placement a ”related party transaction” as such term is defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying on exemptions from the formal valuation and minority approval requirements set out in MI 61-101. The Company is exempt from the formal valuation requirement of MI 61-101 under sections 5.5(a) and (b) of MI 61-101 in respect of the transaction as the fair market value of the transaction, insofar as it involves the interested party, is not more than 25% of the Company’s market capitalization. Additionally, the Company is exempt from minority shareholder approval under sections 5.7(1)(a) and (b) of MI 61-101 as, in addition to the foregoing, (i) neither the fair market value of the Units nor the consideration received in respect thereof from interested party exceeds $2,500,000, (ii) the Company has one or more independent directors who are not employees of the Company, and (iii) all of the independent directors have approved the transaction. Material change reports were not filed 21 days prior to the closing of the financing because insider participation had not been established at the time the financing was announced.

Other placees include new participating groups such as Middlefield Group and certain funds managed by Sprott Asset Management LP, who jointly represent half of the placement, and we are pleased to confirm that Eric Sprott added to his position, maintaining his current ownership percentage.

All securities issued pursuant to the Placement are subject to a four-month-and-one-day hold period. Finders’ fees will be paid to various finders in accordance with Exchange policy.

Financing proceeds will be used to advance Sokoman’s flagship Moosehead Gold Project through a minimum of 10,000 m diamond drill program to focus on deeper testing of the high-grade Eastern Trend to at twice the current tested levels of 200 m vertically (+ 400 m vertical targets), as well as follow-up (including drill testing) of other high priority targets identified by the late 2019 gold in till sampling program (full results expected in Q3) and the recently completed airborne magnetic survey.

Tim Froude, President and CEO of Sokoman, said: “We are delighted to see continued support and interest in our Company from loyal shareholders as well as several major new investors. With this new placement and our existing treasury of $1.4M, we are very well-positioned to move forward with an aggressive drill program here at Moosehead.”

About Sokoman Minerals

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project* (with measured resources of 1.16 million oz of gold at 2.18 g/t, indicated resources of 1.53 million oz of gold at 1.66 g/t and inferred resources of 1.53 million oz. of gold at 1.77 g/t (Marathon Gold Website) 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony/gold project recently optioned to White Metal Resources, and two earlier stage gold properties along the Valentine Lake-Moosehead structural corridor. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which is believed to host potential DSO iron deposits.

*Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman is also applying for JEA funding for the 2020 season.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Non-Brokered Flow-Through Private Placement

St. John’s, NL, June 15, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX-V: SIC; OTCQB:SICNF) today announces that, subject to all regulatory approvals, the Company intends to complete a non-brokered private placement of flow-through shares (the “Private Placement”). The Private Placement is expected to be filed with the Exchange on or around June 19, 2020.

Sokoman intends to issue flow-through shares at a price of $0.115 per flow-through share for gross proceeds of up to $1,500,000. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

In connection with the private placement, the Company will pay finders’ fees of 6% cash and 6% broker warrants, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four month and one day hold period. The Private Placement is subject to approval by the TSX Venture Exchange.

Sokoman’s treasury currently sits at around $1.4M cash. The proceeds of this financing will be used to advance Sokoman’s flagship Moosehead Gold Project through a minimum of 10,000 m diamond drill program to focus on deeper testing of the high-grade Eastern Trend to at twice the current tested levels of 200 m vertically (+ 400 m vertical targets), as well as follow-up (including drill testing) of other high priority targets identified by the late 2019 gold in till sampling program (full results expected in Q3) and the recently completed airborne magnetic survey.

About Sokoman Minerals

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project (with measured resources of 1.16 million oz of gold at 2.18 g/t, indicated resources of 1.53 million oz of gold at 1.66 g/t and inferred resources of 1.53 million oz. of gold at 1.77 g/t (Marathon Gold Website) 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony/gold project recently optioned to White Metal Resources, and two earlier stage gold properties along the Valentine Lake-Moosehead structural corridor. In Labrador, the Company has a 100% interest in the Iron Horse Fe) project which is believed to host potential DSO iron deposits.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.