Newsroom

Sokoman Minerals Corp. Increases Flow-through Private Placement, Announces Hard-Dollar Financing

St. John’s, NL, December 6, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) today announces that further to its November 29, 2023, news release, due to overwhelming demand the Company is increasing its flow-through private placement financing by CAD$483,525 to total aggregate gross proceeds of CAD$3,483,525 (the "FT Financing"). The FT Financing consists of CAD$0.065 units (the "FT Units"), each FT Unit consisting of one flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada), and one-half of a common share purchase warrant (a "Warrant"), each full Warrant being exercisable for one additional common share of the Company, each of which will not qualify as a flow-through share, at an exercise price of CAD$0.13 for 12 months from the date of issue.

The Company is also pleased to announce a non-flow-through CAD$0.065 unit financing (the "NFT Financing") for aggregate gross proceeds of CAD$208,000. The NFT Financing consists of CAD$0.065 units (the NFT Units"), each NFT Unit consisting of one common share of the Company and one common share purchase warrant (the "NFT Warrants"), each NFT Warrant being exercisable for an additional common share of the Company at an exercise price of CAD$0.13 for 24 months from the date of issuance.

All securities issued pursuant to the FT Financing and the NFT Financing (together the "Financings") will be subject to a four-month and one-day hold period.

In connection with the Financings, the Company may pay finders' fees in cash and broker warrants as permitted by the policies of the TSX Venture Exchange (the "Exchange"). The Financings are subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Units, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2024, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2023.

The Company intends to spend approximately 25% of the gross proceeds on the Fleur de Lys gold project, and the remaining balance on its flagship Moosehead gold project.

Tim Froude, CEO of Sokoman commented: "We are grateful that our exploration plans for 2024, which entails diamond drilling on both the Moosehead and Fleur de Lys gold projects will be fully funded. A warm thank you to all our shareholders and investors for their unwavering support."

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Closes First Tranche of Non-Broker Flow-through Private Placement

St. John’s, NL, November 29, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") today announces that, further to its November 21, 2023 news release, it has received conditional approval from the TSX Venture Exchange (the “Exchange”) for its flow-through private placement (the “Private Placement”), for aggregate gross proceeds of up to CAD$3 million.

The Company has now closed the first tranche of the Private Placement and will issue 37,885,000 flow-through share units (“FT Units”) at a price of CAD$0.065 for aggregate gross proceeds of CAD$2,462,525. Each FT Unit consists of one (1) common share of the Company and one half (1/2) of one common share purchase warrant (the “FT Warrant”), with each full FT Warrant entitling the holder to purchase one non-flow-through common share of the Company at a price of CAD$0.13 for a period of 12 months from the date of issuance. The FT Units will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

All securities issued pursuant to this financing will be subject to a four-month plus one-day hold, expiring March 30, 2024.

The first tranche of the Private Placement includes one (1) insider, subscribing for CAD$6,500 or 100,000 FT Units, that portion of the Private Placement a “related party transaction” as such term is defined under MI 61-101 – Protection of Minority Security Holders in Special Transactions. The Company is relying on exemptions from the formal valuation requirement of MI-61-101 under sections 5.5(a) and (b) of MI 61-101 in respect of the transaction as the fair market value of the transaction, insofar as it involves the interested party, is not more than 25% of the Company’s market capitalization.

In connection with the Private Placement, the Company is paying finders’ fees as permitted by the policies of the TSX Venture Exchange.

The net proceeds of the flow-through will be used for project exploration work on the Company’s properties that it controls that will qualify for Canadian Exploration Expenses under the Income Tax Act (Canada). The Company intends to spend approximately 25% of the gross proceeds on the Fleur de Lys Project, and the remaining balance on its flagship Moosehead Project.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is the 100% owned, advanced-stage Moosehead Project and the district-scale Fleur de Lys Project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization. The Company also has a strategic alliance with Benton Resources Inc. (“Benton”) on three, large-scale, joint-venture gold properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc. (“Piedmont”) allowing Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly the Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in 3 stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of newly created Vinland Lithium Inc. that has received $2 million in financing from Piedmont for a 19.9% interest with the balance of ownership between Sokoman and Benton. Sokoman and Benton retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains interests in the Crippleback Lake and East Alder projects along the Central Newfoundland Gold Belt, a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, and the Company has a 100% interest in the Iron Horse (Fe) project in Labrador.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Piedmont Lithium Exercises Initial Earn-In Right For Interest in Killick Lithium; Issues $1 Million in Shares Each to Sokoman and Benton

St. Johns, NL, November 23, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and, Benton Resources Inc. (TSXV: BEX) (“Benton”), together (the "Alliance") are pleased to announce that further to their respective press releases issued on October 11, 2023, Piedmont Lithium Inc. (NASDAQ: PLL) (ASX: PLL) ("Piedmont") provided formal notice to exercise its Initial Earn-In Right to acquire a 16.35% voting and participating interest in Killick Lithium Inc. ("Killick") (the "Initial Interest"). Pursuant to this exercise notice, Piedmont issued to each of Benton and Sokoman, shares of its common stock having an aggregate subscription price of CAD$2.0M based on Piedmont's ten-day volume weighted average price ("VWAP") up to the date of the Initial Interest exercise notice, amounting to 26,099 Piedmont shares issued to each company. In addition, as part of its Initial Earn-In Right, Piedmont will fund work expenditures in the aggregate amount of at least CAD$6.0M (the "Initial Earn-In Amount") within the 30-month period following the Initial Earn-In Right exercise notice. Upon exercise of the Initial Earn-In Right by Piedmont, Piedmont's combined direct and indirect (through Vinland Lithium Inc.) ownership interest in Killick will be equal to approximately 33%.

Piedmont transaction highlights:

Piedmont is one of North America's leading lithium companies

Newfoundland is ranked in the top jurisdictions to explore and develop mineral potential

Benton and Sokoman incorporated Vinland Lithium Inc. ("Vinland") and its wholly-owned subsidiary Killick Lithium Inc. ("Killick"), into which they transferred the Golden Hope Project

Piedmont has vast technical and geological knowledge in similar geology to that of Killick pegmatites

Piedmont financed Vinland CAD$2.0M @ CAD$1.00 per share to hold 19.9%

Piedmont will have the option to earn up to a 62.5% direct interest in Killick by spending an aggregate CAD$12.0M in exploration and development during the option period

Upon Piedmont completing all earn-in options, Piedmont will have paid Benton and Sokoman up to a total of CAD$10.0M in Piedmont shares

Benton and Sokoman to retain a 2% royalty on the net returns of precious metals and the value of lithium received from Killick

Figure 1: Killick Lithium Project relative to Piedmont's asset portfolio

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/188553_1198d132b4b11afd_003full.jpg

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in 3 stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. (TSXV: BEX) is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow. Benton entered into a 50/50 strategic alliance with Sokoman Minerals Inc. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland.

For further information, please contact:

Sokoman Minerals Corp.

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 ext 251

Email: cathy@chfir.com

Benton Resources Inc.

Stephen Stares, President & CEO

Phone: 807-474-9020

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com, www.bentonresources.ca

Twitter: @SokomanMinerals, @BentonResources

Facebook: @SokomanMinerals, @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation including statements regarding exploration and development activities; plans for mineral projects; strategy; and expectations regarding future expenditures. Such forward-looking statements involve substantial and known and unknown risks, uncertainties and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance or achievements and other factors to be materially different from the future timing of events, results, performance or achievements expressed or implied by the forward-looking statements. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: political and regulatory risks associated with mining and exploration; the potential for delays in exploration or development activities or the completion of feasibility studies; risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions the uncertainty of profitability); risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays; uncertainties inherent in the estimation of lithium resources; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies; changes in the market prices of lithium and lithium products; and other risks and uncertainties related to Benton's and Sokoman's respective prospects, properties and businesses detailed elsewhere in each of their respective disclosure records. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and Benton and Sokoman do not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from Benton's and Sokoman's respective expectations or projections.

Sokoman Announces Non-Brokered Flow-Through Private Placement For Gross Proceeds of Up To CAD$3M

St. John’s, NL, November 21, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") announces a non-brokered private placement of flow-through (“FT”) units (the “Private Placement”) for gross proceeds of up to CAD$3,000,000. The Private Placement is expected to close on or before November 30, 2023.

The Private Placement is priced at $0.065 per FT Unit, each FT Unit consisting of one flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada), and one-half of one common share purchase warrant (a “Warrant”), each full Warrant being exercisable for one additional common share of the Company, each of which will not qualify as a flow-through share, at an exercise price of $0.13 for 12 months from the date of issue.

All securities issued pursuant to the Private Placement will be subject to a four-month and one-day hold period.

In connection with the Private Placement, the Company may pay finders’ fees in cash as permitted by the policies of the TSX Venture Exchange. The Private Placement is subject to approval by the TSX Venture Exchange.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Units, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2024, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2023.

The Company intends to spend approximately 25% of the gross proceeds on the Fleur de Lys Gold project, and the remaining balance on its flagship Moosehead Gold project.

The Company is well-funded to cover corporate and working capital needs for 2024 with ~$2M in cash and securities in the treasury.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in 3 stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman and Benton Receive Explorer of the Year Award for the Killick Kraken Lithium Project from the Canadian Institute of Mining, Metallurgy and Petroleum Newfoundland and Labrador Branch

St. John’s, NL, November 2, 2023 – Sokoman Minerals Corp. TSXV:SIC)(OTCQB:SICNF) ("Sokoman") and Benton Resources Inc. (TSXV:BEX) ("Benton") together, (the "Alliance") are pleased to announce that the Alliance has received the "Explorer of the Year" award at the annual CIM Mineral Resources Review in Newfoundland. The award was presented by the Newfoundland and Labrador branch of the Canadian Institute of Mining, Metallurgy and Petroleum. The award is presented to a prospector, exploration team, or company that has made a recent and significant mineral discovery; or significantly enhanced a prospect or deposit; or identified a previously unrecognized prospective geological environment in Newfoundland and Labrador. The Alliance has received the award due to the ongoing success at its Killick and Kraken Lithium discovery (formerly the Golden Hope Property) which has produced significant surface sampling and drill results up to 1.04% Li2O over 15.23 m in GH-22-27, 1.08% Li2O over 9.50 m in GH-22-26, 1.22% Li2O over 13.37 m in GH-23-45, 0.81% Li2O over 21.00 m, and 0.99% Li2O over 10.16 m in GH-23-46. In addition, the Alliance recently executed a CAD$24 million option agreement with Piedmont Lithium Inc. further endorsing the potential of this prospective lithium project. (see news release dated October 11, 2023).

After the presentation of the award, Tim Froude President and CEO of Sokoman stated: "We are deeply honoured to have been chosen to receive this prestigious award for a second time. We truly thank the CIM in Newfoundland and Labrador who have chosen to recognize us for doing the work we love to do! We are extremely excited about the potential of the amazing Killick Lithium Project as we assist Vinland Lithium Inc. in taking it to the next level."

From Left: Stephen Stares (Benton Resources Inc.), Timothy Froude (Sokoman Minerals Corp.), Amy Copeland (CIM NL Branch)

Piedmont transaction highlights:

Piedmont is one of North America's leading lithium companies

Newfoundland is ranked in the top jurisdictions to explore and develop mineral potential

Sokoman and Benton incorporated Vinland Lithium Inc. ("Vinland") and its wholly-owned subsidiary Killick Lithium Inc. ("Killick"), into which they transferred the Golden Hope Project

Piedmont has vast technical and geological knowledge in similar geology to that of the Killick pegmatites

Piedmont financed Vinland CAD$2.0M @ CAD$1.00 per share to hold 19.9%

Piedmont will have the option to earn up to a 62.5% direct interest in Killick by spending an aggregate CAD$12.0M in exploration and development during the option period

Upon Piedmont completing all earn-in options, Piedmont will have paid Sokoman and Benton up to a total of CAD$10.0M in Piedmont shares

Sokoman and Benton to retain a 2% royalty on the net returns of precious metals and the value of lithium received from Killick

QP

Timothy Froude (P.Geo.), President and CEO of Sokoman Resources Corp., the 'Qualified Person' under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage, Moosehead, as well as Crippleback Lake (available for option); and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton Alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly the Golden Hope Project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received CAD$2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Drilling Update - Moosehead Gold Project, Central Newfoundland

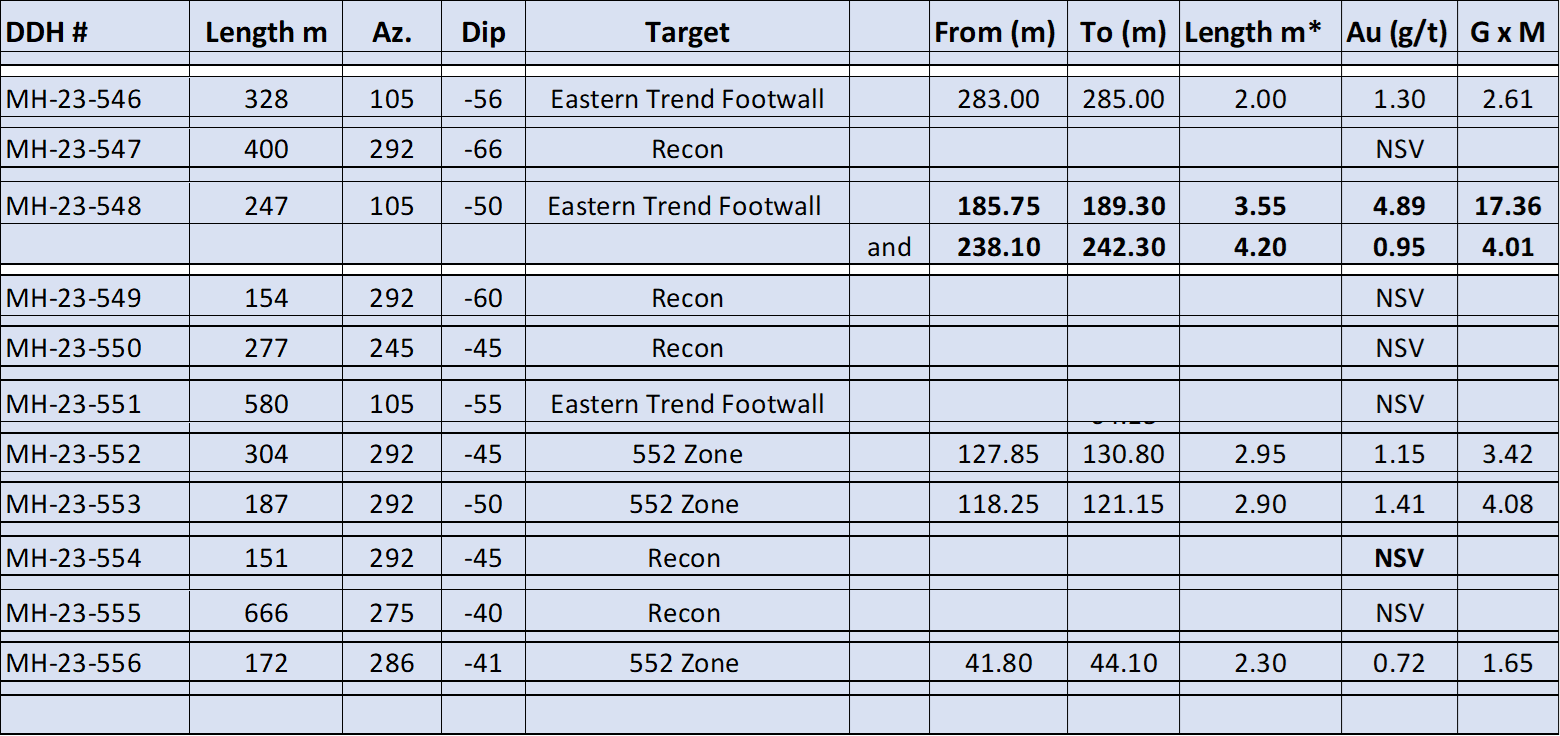

A New Mineralized Structure, the 552 Zone, Intersected in Four Holes; Remains Open

St. John’s, NL, November 2, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to provide an update on the ongoing drilling program at the 100%-owned Moosehead project. Diamond drilling has identified a new mineralized structure 200 m to the east of the Eastern Trend, the furthest east of any mineralization located to date. Dubbed the 552 Zone, after the first hole that cut it, it has an apparent east-west strike, making it close to perpendicular to the Eastern Trend, suggesting that it lies in a similar structural setting as the 463 Zone but above the Eastern Trend, in the hanging wall, whereas the 463 Zone lies in the footwall of the Eastern Trend.

Tim Froude, President and CEO of Sokoman, says: "While not exhibiting high grade to date, the fact that the 552 Zone structure has gold in it is good news as we know we can get variable grades interspersed with higher grades in all zones at Moosehead. On this property, we drill first for structure and then seek out the grade. I am extremely pleased with this development since we see sulphide minerals, commonly associated with the higher-grade Au, including boulangerite and sphalerite and we are looking forward to evaluating this new zone. The presence of gold-bearing structures in MH-23-555 is also very significant as it is a wide step-out hole and confirms the presence of mineralizing fluids in this area and extends the Eastern Trend to the east. We expect to go over the 100,000 m mark in the ongoing Phase 6 program sometime this month and look forward to continued drilling at Moosehead."

The mineralized quartz 552 Zone has been intersected in all four holes (552, 553, 556, and 557) completed, with assays received for three of the four. Boulangerite and sphalerite, minerals associated with Au on the Moosehead property, are noted. The best grade intersected to date is 1.41 g/t Au over 2.9 m in DDH 553 with 1.15 g/t over 2.95 m in DDH 552. The 552 Zone has been tested by two sections of two holes each drilled from the same setup giving a 10-m strike-length, over a vertical range of approximately 25 m. The drilling tested a resistivity high noted in the winter Alpha IP survey with several second-order targets also identified in the general area. A Noranda float sample from the late 1980s, that assayed 10.3 g/t Au, is located close to the 552 Zone. The 552 Zone remains open with approximately 2500 m of drilling planned to test along strike and to depth.

Results include three holes in the Eastern Trend footwall, testing for near surface mineralization in the same orientation as the vein set in the deeper 463 Zone. The 463 Zone returned an earlier intercept of 39.60 m grading 12.50 g/t Au, including 10.5 m @ 41.97 g/t Au (see December 15, 2022 press release). The best results, from MH-23-548, gave 4.89 g/t Au over 3.55 m from 185.75 m downhole (see Table 1 below) ~250 m NW of, and 150 m vertically above, the 463 Zone with a second zone intersected in DDH 548, giving 0.95 g/t Au over 4.20 m. Drilling will continue to test the footwall environment which remains very prospective for additional gold-bearing structures.

Table 1 - Assay Results

*Core length - true widths are estimated to be approximately half the core length

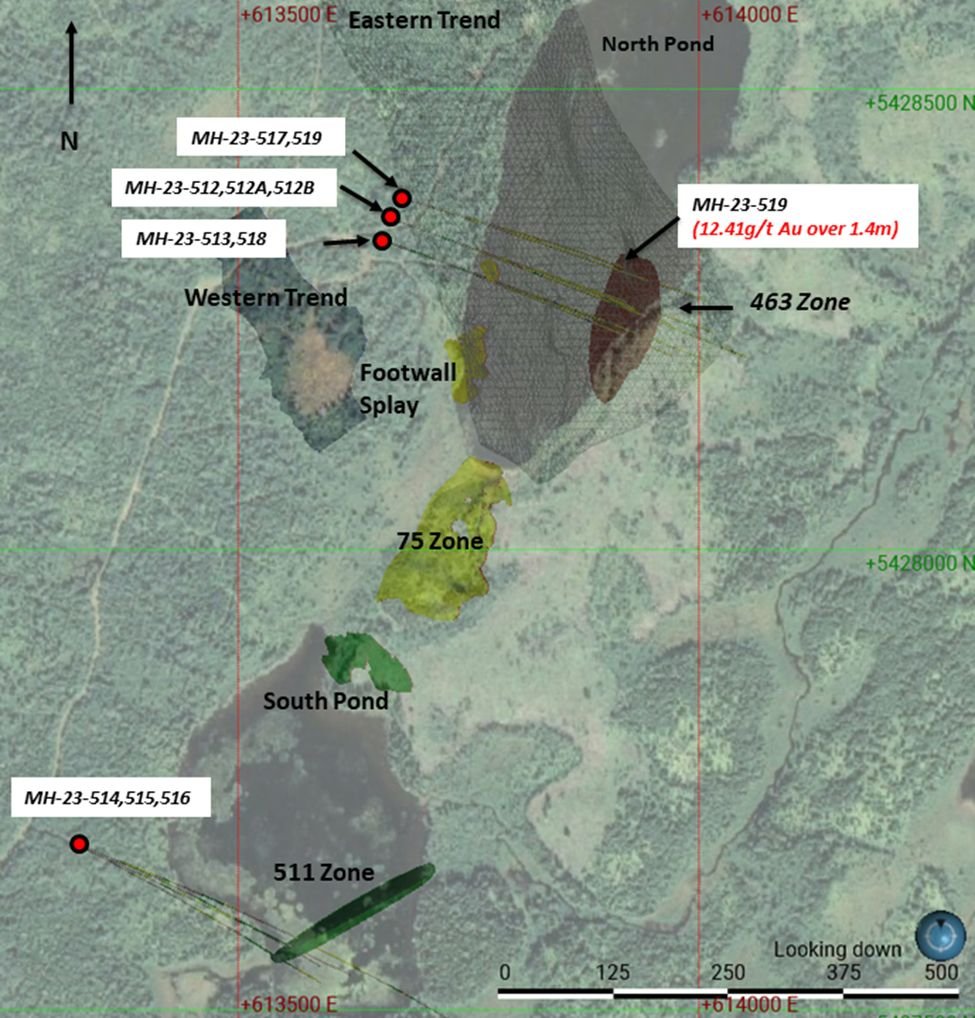

Plan view of recent drilling

Reconnaissance holes MH-23-547, 549, 550, and 554 were drilled to test IP targets. Hole MH-23-555 was a 100 m step-out testing the down-plunge projection of the Eastern Trend to the north. There are several zones of deformation in the hole with the strongest structure occurring from 586.4 m - 592.7 m. Here strongly deformed and broken quartz veins and vein fragments occur within a pyritized and broken, light-grey sediment. A second zone of weak deformation occurs from 464.4 m - 475.8 m with upwards of 20% stockwork and stylolitic textured quartz veins. This zone contains anomalous gold with occasional traces of pyrite, sphalerite, and arsenopyrite with a best assay of 0.93 g/t Au over 0.40 m. The presence of multiple structures with mineralogy similar to high-grade zones elsewhere on the property is significant, additional drilling will be recommended for this area.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes the whole sample being crushed to -10 mesh, and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly-emerging gold districts. In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in 3 stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Piedmont Lithium Inc. Enters into Definitive Agreements with Sokoman and Benton to Acquire an Interest in the Killick Lithium Project

St. John’s, NL, October 11, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) are pleased to announce the entering into of the Definitive Agreements (as defined below) with Piedmont Lithium Inc. (NASDAQ: PLL) (ASX: PLL) and its subsidiaries ("Piedmont"), enabling Piedmont to earn up to a 70% direct and indirect ownership interest in the area and lands comprising the Golden Hope project (the "Golden Hope Project") to be renamed the Killick Lithium Project, located in southwestern Newfoundland (the "Transaction").

Piedmont transaction highlights:

Piedmont is one of North America's leading lithium companies

Newfoundland is ranked in the top jurisdictions to explore and develop mineral potential

Benton and Sokoman incorporated Vinland Lithium Inc. ("Vinland") and its wholly-owned subsidiary Killick Lithium Inc. ("Killick"), into which they transferred the Golden Hope Project

Piedmont has vast technical and geological knowledge in similar geology to that of Killick pegmatites

Piedmont financed Vinland CAD$2.0M @ CAD$1.00 per share to hold 19.9%

Piedmont will have the option to earn up to a 62.5% direct interest in Killick by spending an aggregate CAD$12.0M in exploration and development during the option period

Upon Piedmont completing all earn-in options, Piedmont will have paid Benton and Sokoman up to a total of CAD$10.0M in Piedmont shares

Benton and Sokoman to retain a 2% royalty on the net returns of precious metals and the value of lithium received from Killick

Figure 1: Killick Lithium Project relative to Piedmont's asset portfolio

Pursuant to the terms of the Transaction, (i) each of Benton and Sokoman assigned all of its rights and interests to the Golden Hope Project (the "Golden Hope Project Rights") to Vinland, a newly incorporated British Columbia corporation, in exchange for all of the issued and outstanding shares in the capital of Vinland, held by each in equal proportions, and, in turn, Vinland assigned the Golden Hope Project Rights to its newly incorporated, wholly-owned subsidiary, Killick (the "Reorganization"). Upon the completion of the Reorganization, Vinland and Piedmont, entered into (i) a subscription agreement (the "Subscription Agreement") pursuant to which Piedmont subscribed for a 19.9% ownership interest in Vinland for an aggregate subscription amount of CAD$2.0M (the "Subscription"); and (ii) a shareholders' agreement (the "Vinland SHA") with Benton and Sokoman setting forth the framework for the governance of Vinland and for the holding, disposal and subsequent issuances of interests in Vinland.

Upon the completion of the Subscription, Killick and Piedmont entered into (i) an earn-in agreement, pursuant to which Piedmont was granted the option to acquire up to a direct 62.5% ownership interest in the Golden Hope Project (the "Earn-In Agreement"), (ii) a royalty agreement pursuant to which Benton and Sokoman were granted an aggregate 2% royalty on the net returns of precious metals and the value of lithium received from the Golden Hope Project (the "Royalty Agreement"), and (iii) a marketing agreement pursuant to which Piedmont was granted the exclusive marketing rights for the promotion and sale of lithium products produced from the Golden Hope Project, including the right to purchase any uncommitted project production on commercially reasonable arm's length terms, the whole as further set forth below (collectively with the Subscription Agreement, the Vinland SHA, the Earn-In Agreement and the Royalty Agreement, the "Definitive Agreements"). Upon the acquisition of the Initial Interest (as defined below), Vinland, Killick, and Piedmont shall enter into a shareholders' agreement (the "Killick SHA") pursuant to which the parties thereto set forth the framework for the governance of Killick and for the holding, disposal, and subsequent issuances of interests in Killick.

Transaction Details

Pursuant to the Earn-In Agreement, Piedmont was granted the option (the "Initial Earn-In Right"), exercisable by notice, to acquire a 16.35% voting and participating interest in Killick (the "Initial Interest") in consideration of (i) the issuance by Piedmont to each of Benton and Sokoman of shares of its common stock having an aggregate subscription price of CAD$2.0M based on Piedmont's ten-day volume weighted average price ("VWAP") up to the date of the Initial Interest exercise notice, and (ii) payment of work expenditures in the aggregate amount of at least CAD$6.0M (the "Initial Earn-In Amount") within the 30-month period following the Initial Earn-In Right exercise notice.Upon exercise of the Initial Earn-In Right by Piedmont, Piedmont's combined direct and indirect (through Vinland) ownership interest in Killick will be equal to approximately 33%.

Within 60 days following the funding of the Initial Earn-In Amount, Piedmont shall have the option (the "First Additional Earn-In Right"), exercisable by notice, to acquire an additional 21.65% (totaling 38%) voting and participating interest in Killick (the "First Additional Interest") in consideration of (i) the issuance by Piedmont to each of Sokoman and Benton of shares of its common stock having an aggregate subscription price of CAD$2.0M based on Piedmont's ten-day VWAP up to the date of the First Additional Earn-In Right exercise notice, and (ii) payment of work expenditures in the aggregate amount of at least CAD$3.0M (the "First Additional Earn-In Amount") within the 12-month period following the First Additional Earn-In Right exercise notice. Upon exercise of the First Additional Earn-In Right by Piedmont, Piedmont's combined direct and indirect (through Vinland) ownership interest in Killick will be equal to approximately 50%.

Within 60 days following the funding of the First Additional Earn-In Amount, Piedmont shall have the option (the "Second Additional Earn-In Right"), exercisable by notice, to acquire an additional 24.5% (totaling 62.5%) voting and participating interest in Killick (the "Second Additional Interest") in consideration of (i) the issuance by Piedmont to each of Benton and Sokoman of shares of its common stock having an aggregate subscription price of CAD$6.0M based on Piedmont's ten-day VWAP up to the date of the Second Additional Earn-In Right exercise notice, and (ii) payment of work expenditures in the aggregate amount of at least CAD$3.0M (the "Second Additional Earn-In Amount") within the 12-month period following the Second Additional Earn-In Right exercise notice. Upon exercise of the Second Additional Earn-In Right by Piedmont, Piedmont's combined direct and indirect (through Vinland) ownership interest in Killick will be equal to approximately 70%.

Royalty Agreement

Concurrently with the entering into the Earn-In Agreement, Killick shall grant an aggregate 2% royalty on the net returns of precious metals and the value of lithium received from the Golden Hope Project to Benton and Sokoman; provided, however, that Killick, Piedmont or any of their successors shall have the right to repurchase 50% of such royalty (1%) in consideration for an aggregate cash payment of CAD$2.0M to Benton and Sokoman (CAD$1.0M to each).

Marketing and Purchase Rights

As part of the Transaction, Killick and Piedmont entered into a marketing rights agreement granting Piedmont 100% marketing rights and the right to purchase, under a right of first offer, any uncommitted lithium concentrate produced by the Golden Hope Project on commercially reasonable arm's length terms.

Timothy Froude, P.Geo., President and CEO of Sokoman Minerals states: "This agreement solidifies many positives for the project, and for the Sokoman-Benton alliance, as it delivers credibility to Golden Hope as a potentially significant Critical Minerals exploration play, and it lends strong support to our exploration efforts at Golden Hope to date. The markets are challenging at this time and to be able to partner with a company the calibre of Piedmont Lithium Inc., with the financial and technical strengths it carries, is very significant."

President and CEO Stephen Stares of Benton comments: "We are extremely pleased to be partnering with such a high-profile and professional team as Piedmont. Through our due diligence period, we've learned that the Golden Hope Project will benefit tremendously from the combined knowledge of both teams. We believe this new alliance will be beneficial for all involved, as we continue to unlock Newfoundland's lithium potential."

About Sokoman Minerals Corp.

Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company's primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (available for option) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims - 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada's newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, Sokoman has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. (TSXV: BEX) is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow. Benton entered into a 50/50 strategic alliance with Sokoman Minerals Inc. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland.

For further information, please contact:

Sokoman Minerals Corp.

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 ext 251

Email: cathy@chfir.com

Benton Resources Inc.

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

Sokoman Minerals Reports Visible Gold at Fleur de Lys Gold Project North-Central Newfoundland

Newly Discovered Golden Bull Prospect Reports 9.02 g/t Au

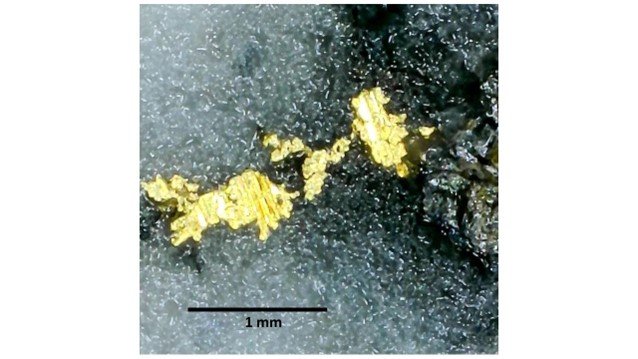

St. John’s, NL, October 4, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to announce that ongoing exploration at Fleur de Lys has outlined an area of very angular, visible gold-bearing float dubbed the Golden Bull Prospect, measuring 300 m in length and as yet unknown width, with numerous pieces of banded quartz weighing up to several tonnes (see Photo 1). The Golden Bull Prospect is located in the northern portion of the property, four km to the west of the mining town of Baie Verte.

In 1988, Noranda Exploration reported gold from two bedrock occurrences (Castor Pond and Castor Pond North) with grab samples to 7.46 g/t Au, and channel samples to 8.49 g/t Au over 0.40 m, approximately 500 m to the southwest of the Prospect. Noranda drilled a single hole (CP-88-01) at the Castor Pond occurrence, with only anomalous values intersected including 0.42 g/t Au over 0.20 m and 0.30 g/t Au over 0.30 m. Mineralization described in the core log for CP-88-01 (a quartz breccia) does not resemble the Golden Bull Prospect mineralization. No other drilling has been carried out on the property.

Tim Froude, President and CEO of Sokoman, commented: "We see increasing potential for a significant gold deposit with every round of work we do. The Golden Bull Prospect is an example of gold occurrences discovered using basic prospecting methods in the follow-up of our gold in till anomalies. The simple mineralogy, mostly pyrite with gold, is very similar to that of the large, Curraghinalt gold deposit in Northern Ireland which lies in equivalent rocks to those at Fleur de Lys. We are carrying out a detailed B-horizon soil sampling survey in the immediate area of the Golden Bull Prospect and are also considering a high-resolution magnetic survey to identify structures that could host the Golden Bull Prospect veins. We are also delighted to learn that the discovery area is scheduled to be logged throughout the coming winter which will provide additional access, and possibly expose more quartz float and/or the source of the mineralized boulders, saving the Company considerable exploration expense. This additional exploration is critical to help us plan an effective follow-up program including drilling.

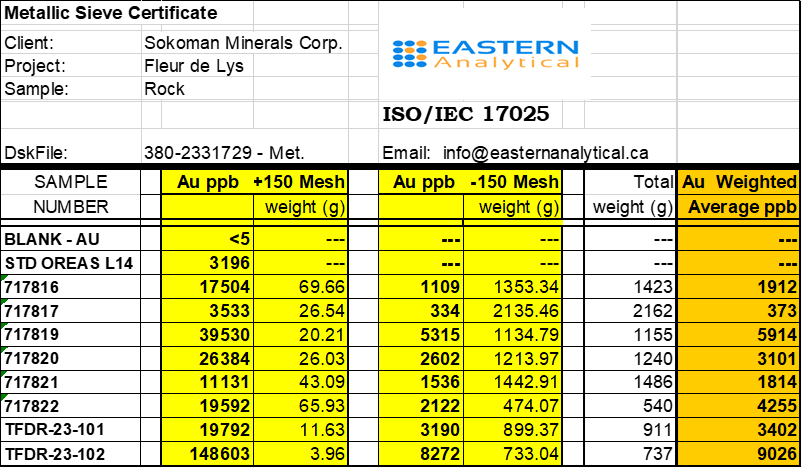

The Golden Bull mineralization consists of strongly stylolitic (banded) quartz, with up to 2% disseminated pyrite, arsenopyrite, sphalerite, and minor chalcopyrite. Visible gold is noted (see sample 717819 in Photo 2). Assay results from metallics assays of the grab samples suggest that visible gold is common in the Golden Bull Prospect veins based on the amount of gold reporting to the coarse fraction (+ 150 mesh) with seven samples giving values from 11,131 to 148,603 ppb Au (see table following).

Note: All rock samples from Fleur de Lys are being assayed by the Total Pulp Metallic Analysis method at Eastern Analytical Ltd. in Springdale, NL.

Photo 1: Large, angular, stylolitic quartz float - Golden Bull Prospect

Photo 2: Visible gold from the Golden Bull Prospect - Sample 717819

Note: The mineralization pictured is not representative of the quartz/pyrite mineralization.

The Fleur de Lys Gold Project

The 100%-owned project is located on the west side of the Baie Verte Peninsula in north-central Newfoundland, an area that has a long history of base metal and gold production dating back to the 1860s. The project area is highly prospective for Dalradian-style (e.g., Curraghinalt*) orogenic, vein-hosted, gold deposits and as such, it is a readily accessible, yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The Fleur de Lys Supergroup, which underlies the project, includes equivalent rocks to the Dalradian Supergroup in the UK, where three significant gold deposits, the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland, are found. The Dalradian, vein-hosted, gold deposits occur in moderate to high-grade metamorphic terranes and are typically high grade.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Rock Sample Analysis

Rock sample analysis (gold by fire assay) completed at Eastern Analytical Ltd., in Springdale NL. Samples were delivered in sealed bags directly to the lab by Sokoman's personnel. Eastern Analytical Ltd. ("Eastern") is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Eastern routinely inserts industry-accepted standards and blanks in all sample runs performed as well as completing random duplicate analysis. All core samples submitted for assay were saw cut by Sokoman's personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman's personnel. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. Total pulp metallic analysis includes the whole sample being crushed to -10 mesh and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage, Moosehead, as well as Crippleback Lake (available for option); and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton Alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby and/or referenced properties is not necessarily indicative of mineralization hosted on the Company's property.

*The Curraghinalt deposit has >6 million ounces of NI 43-101 compliant gold resources including 6.34 million tonnes at 15.01 grams per tonne (Measured and Indicated) for 3.06 million ounces; and 7.72 million tonnes at 12.24 grams per tonne gold (Inferred) for 3.03 million ounces {2018 Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada)}.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Fleur de Lys project through the Junior Exploration Assistance Program.

For further information, please contact:

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Drilling Update - Moosehead Gold Project, Central Newfoundland

St. John’s, NL, September 14, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to provide the following update on the ongoing drilling program at the 100%-owned Moosehead gold project. Diamond drilling in the 463 Zone and adjoining footwall environment has intersected gold mineralization which helps to determine the plunge of the favourable structure hosting the 463 Zone and other proximal parallel mineralized zones in the footwall under the main Eastern Trend. The best intersections from the drill holes reported today are MH-23-536 and 542, which targeted the down-plunge extension of the 463 Zone which has an earlier intercept of 39.60 m grading 12.50 g/t Au including 10.5 m @ 41.97 g/t Au (see the December 15, 2022 news release).

Tim Froude, President and CEO of Sokoman, says: "Drilling will continue at Moosehead with two rigs, focused mainly on testing the Alpha IP targets outlined last winter. We have also begun trenching near-surface IP anomalies and soil geochemical anomalies. We are also defining a deeper target, below 500 metres, using our understanding of the structural geology of the main Eastern Trend from consultant, Dr. David Coller. We expect to be drilling until the Christmas break."

The table below gives the drill results for the 463, South Pond, and 75 Zones and also several reconnaissance holes.

*80-90% true thickness

Drill Plan Map

Drill holes MH-23-536 and 542 were drilled to follow up a 1.4 m intersection of visible gold-bearing quartz veins that gave 12.41 g/t Au from 409.75 m downhole (see the April 13, 2023 news release) an 80 m step-out, 56 m down plunge, from MH-22-463 in the 463 Zone. Results indicate that the zone remains open down-plunge. Other holes testing the 463 Zone area returned only anomalous results.

The South Pond drilling focused on the down-plunge extension of drill holes MH-20-123 - 5.00 m @ 26.87 g/t Au and MH-20-141 - 4.20 m @ 64.00 g/t Au (see the July 20, 2021 news release). Multiple zones of lower-grade gold mineralization were intersected suggesting the zone remains open to depth.

The 75 Zone was tested with three holes with only one hole (MH-23-529) giving significant mineralization. Additional drilling is planned to try to extend the high-grade mineralization intersected in MH-21-263 that gave 4.80 m @ 12.86 g/t Au.

Reconnaissance holes include MH-23-538, 539, 541, 543, and 544 drilled near the Bowtie area to the north of North Pond, with MH-23-545 drilled near the northeastern property boundary testing a mag high. Only one hole, MH-23-539, returned anomalous gold values.

The Company has started testing IP targets defined by the winter Alpha IP survey that defined several first- and second-priority targets below and to the west of the Western Trend as well as targets in the 253 Zone, 200 m to the east of the main Eastern Trend. Results of the first two holes MH-23-547 and 549, testing the Western Trend area, are pending.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, as well as Crippleback Lake (available for option); and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton Alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman and Benton Report Latest Results at Golden Hope JV - Southwestern Newfoundland

St. John’s, NL, September 6, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (the “Alliance”) is pleased to announce that it has received further results from the Phase 4 diamond drilling program completed at the Kraken Lithium swarm. To date, a total of 10,095 m of drilling has been completed in four phases at the main discovery areas, as well as an additional 522 m in six holes at the Hydra Dyke, 10 km to the northeast. Most of the Phase 4 drilling was completed in the East Dyke and Killick Dyke areas where the Alliance previously announced 2022 and 2023 drilling returned up to 1.04% Li2O over 15.23 m in GH-22-27, 1.08% Li2O over 9.50 m in GH-22-26, 1.22% Li2O over 13.37 m in GH-23-45, 0.81% Li2O over 21.00 m, and 0.99% Li2O over 10.16 m in GH-23-46. The latest drill program has expanded the dyke system to the south and has intersected a new dyke to the east of Killick, which requires further testing. Referred to as Killick East, this new dyke was intersected in drill holes GH-23-47, GH-23-56, and GH-23-59 over a 100 m strike length and returned values up to 1.54 m @ 0.68% Li2O in hole GH-23-56. The Killick Dyke system remains open to the north and at depth. The Alliance is currently planning a Phase 5 program to begin in late September or early fall, 2023. The Phase 5 program will test numerous new targets generated from current mapping and channel sampling as well as the main Kraken Dyke swarm area (including Kraken West and Kraken North) and drilling to expand the East Dyke and Killick Dyke areas.

Steve Stares, President and CEO of Benton Resources Inc. said: “Lithium-rich pegmatite dykes are highly variable and complex, but our approach of using multiple exploration techniques continues to expand the target zone of this massive, still early-stage pegmatite field. Prospecting, soil sampling, trenching, channel sampling, and diamond drilling all continue to provide essential data and encourage us to continue to the next phase of the work, including some excellent drill targets for the Phase 5 program.”

Table 1 – Phase 4 Diamond Drill Results

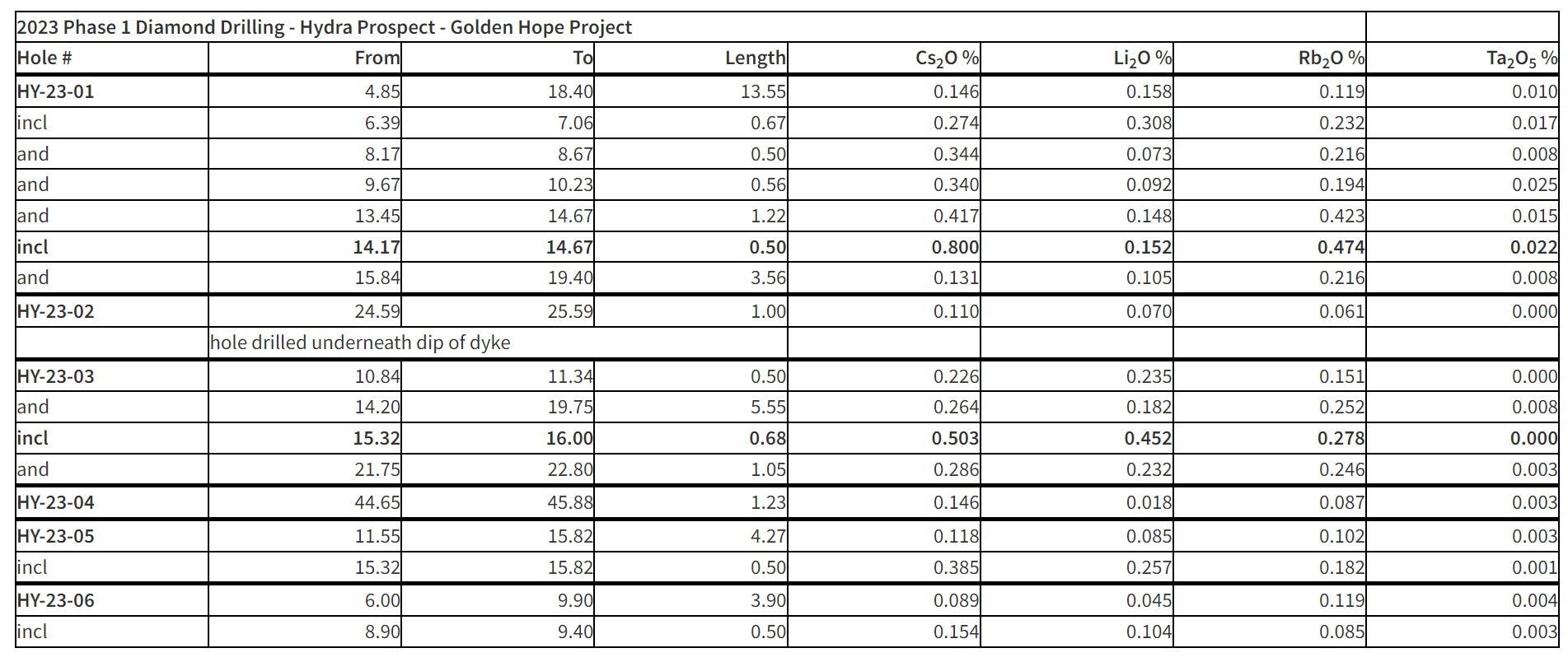

Hydra Prospect Drilling

The Alliance is also pleased to announce that it has received significant results from the six-hole (522 m) reconnaissance diamond drilling program recently completed on the Hydra (cesium/lithium/tantalum) target 10 km northeast of the Killick Dyke.

Initial drilling on the Hydra Dyke was successful in intersecting cesium-lithium-rubidium-tantalum mineralization in four of the six holes completed. The drilling has confirmed the continuation of mineralization at depth and along strike to the north for approximately 100 m. Highlights of the Phase 1 drilling include:

13.55 m grading 0.14% Cs2O from 4.85-18.4 m including 1.22 m grading 0.51% Cs2O from 13.45 m - 14.17 m (Hole HY-23-01)

Additional work completed on the Hydra Dyke includes detailed channel sampling at the discovery outcrop (44 samples) and geological mapping. The sections sampled are mineralogically similar to the previous surface sampling and in recent drilling. The best results from channel sampling in 2022 at Hydra averaged 8.76% Cs2O, 0.41% Li2O, 0.025% Ta2O5, and 0.33% Rb2O over a 1.2 m channel cut (see news release December 1, 2022). Additional results will be reported as received and after compilation in the coming weeks. The Alliance is planning further follow-up work including deeper drilling and testing the dyke along strike to the south. To date, the Hydra Dyke has only been tested to the north of the discovery outcrop.

Table 2 - Phase 1 Diamond Drill Results - Hydra Prospect

Kraken Area Channel Sampling

The Alliance has completed a series of channel cut samples across numerous newly discovered, as well as known, dykes exposed during previous and ongoing prospecting and trenching activities at Golden Hope. The most significant are newly exposed dykes to the west and north of the Kraken Discovery area. A number of these exposures have yet to be drill tested and will be tested as part of the upcoming Phase 5 diamond drilling program later this fall. In addition, channel sampling was carried out over known dykes trenched earlier this year or late 2022. All channel results are pending.

A total of 186 channel samples have been collected and most are currently being analyzed as sampling continues. Most samples were channeled across well-mineralized spodumene-bearing pegmatite dykes and sample lengths range from 0.35 m to 1.0 m, with an average of approximately 0.8 m. Channel samples were collected (from west to east) from the following areas:

1% Trench - 10 channel samples ranging from 0.6 m to 1.0 m in length were collected where 2022 prospecting sampling returned a grab sample assaying 1.11% Li2O to the west of the Kraken Discovery area. All pegmatite dyke channel samples contained significant spodumene and the dyke will be drill tested in the Phase 5 program.

Colin's Turn Trench - 13 channel samples ranging from 0.5 m to 1.0 m in length were collected on the west end of the Kraken North Dyke as currently exposed. Two continuous channel cuts sampled spodumene mineralization over 2.0 m in width and are similar to that in the dyke further east. Drilling is planned for this location in the Phase 5 program.